Tuesday, July 31, 2007

Buy and Bale

The bulls looking for a bottom would have much rather bought a sharply lower opening than the rally that appeared this morning. Buying and baling can get tiring. The sellers have had a tactical advantage over the past week and can sell most rallies without extreme pain. Chopping down into a bottom over the next few sessions would suit many friendlies. However, the price action on the downside is as bad as it has been for sometime. This is a liquidation break and those can have some ugly momentum. Models are rotational.

Monday, July 30, 2007

Hammerville Revisited

The markets revisited the area they were routed from late Friday. The DJA 13400 and the SP futures 1485 now will become a technical focal point over the next few trading sessions. The bulls have once again demonstrated elements that have made the bull run famous, the ability to take a pounding. The bulls however may be pressed to repudiate the entire break in order to avoid the hammer beyond this week. Whatever the reasons for last weeks break, the volume and volatility are clear signs that a further roll-over in price action may increase the downside velocity.

Models are still rotational.

Models are still rotational.

Sunday, July 29, 2007

Heavy Lifting

There are times when it pays to watch the trade a bit more than you trade the trade. The various tremors rumbling through the market are the sounds of larger players moving the furniture. That may become more of a factor in the week ahead. Readjustments, liquidation, and margin conditions can bring about situations where it is better to let some of the giants wrestle. Large positions executed by various players can set previously successful strategies spinning. Traditional technical indicators may become distorted and unreliable. The RSI crowd and other limited over sold over bought programs will be of no use. Many times initiating a trade will be like grabbing onto a fast moving object.

The bulls will have every opportunity this week to prove they are still in control. They can be aided in a variety of ways that include the Fed. Most of all it will be how fast they can leave a bottom behind them.

The bulls will have every opportunity this week to prove they are still in control. They can be aided in a variety of ways that include the Fed. Most of all it will be how fast they can leave a bottom behind them.

Friday, July 27, 2007

Just in Case

Late in the session the traders and managers implemented the 'just in case the market sucks Monday' strategy. The bears kept on hitting it without enduring hardly any pain. If you believe that it is not how they start, but how they finish, then start packing. Next week, a serious battle for a market bottom will take place with the bears looking to ride the liquidation train to a level that even they would buy. Of course they will be looking to sell any meaningful rallies. Models had a lot of rotation today even with the late sell off. Next week will bring what traders live for, volatility and opportunities to make money moving both ways.

Thursday, July 26, 2007

Raise Your Forks?

This market is tired of lugging the bad credit story and the gamed numbers that every earnings report seems to bring. Whether the "liquidity tsunami" as it has been called can save the bull run will be of great interest. The market will fight to make a bottom next week after the friendlies trot out the "nothing has changed" overview. They may be right but todays action is coming off a recent new high, not a lengthy pullback. This type of market rejection creates willing sellers on decent rallies. Models have moved from pointing south to rotational.

Wednesday, July 25, 2007

Technicals

The crunch areas for the SP500 and NQ100 futures are 1532.5 and 2035 respectively. The bulls have always been able the wait for the next train coming through and looking at the data there are few difference between the last seven days of action and other market setbacks. However, the models keep on leaning south and have yet to return to their 'that's enough break' config. The bear needs to see the DJA take out the lows of the plus 285 rip day (13600) and slide through the July lows before raising the fork.

Tuesday, July 24, 2007

Wackage or Wreckage?

Tuesdays as mentioned in the previous post have been a sore spot for the stock market. But will this break prove to be anything more than the previous nine or ten head fakes lower. If you listen to people like Bill Gross of Pimco, the end is always near. Never one to avoid his position, he has been brow beating the Fed over the need to cut rates as Pimco's long bond positions have had to endure hard breaks. Now bonds have rallied, stocks seem a bit shaky, and it all may be enough to turn on the stock disposal. The models are heavy but will run out of gas without big downside. But the tables may have turned a bit. Instead of the bull always being forgiven, it may be the bear's turn to have more opportunities to escape. Of course, waiting to escape from trades is always so pleasant.

Tuesdays

Tuesdays seem to be a bit hard on these markets. February 27th and March 13th fell on such a day of the week. Here the market is somewhat vulnerable to 'wackage' since it comes after a session which appeared to put a bid in the market. Traders can sense weak legs when taking out the previous days lows and will push the downside to see if there are stop loss points. If this market decides the credit problems will exceed any glee from earnings , then the bears will begin to recapture some listeners.

Monday, July 23, 2007

Price Construct

Our models crunch the SP500 and the Nasdaq100 indexes which are used as primary indicators for overall market technical conditions. Their performance measures the strength of the "price construct' that is occurring during the coarse of the trading day. The 'construction' and deconstruction of price is probed using buy and sell decisions executed by the models. So what are they saying? See Dow 14000 post.

Our models crunch the SP500 and the Nasdaq100 indexes which are used as primary indicators for overall market technical conditions. Their performance measures the strength of the "price construct' that is occurring during the coarse of the trading day. The 'construction' and deconstruction of price is probed using buy and sell decisions executed by the models. So what are they saying? See Dow 14000 post.

Sunday, July 22, 2007

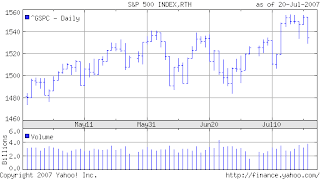

What is the old line? What's at the bottom of

every sunken ship? Charts. This chart has a

few problems and might provide courage to the market bear. The short seller needs a high profile failure to pick-up any downside momentum. Another hard leg down in Google would convince us that there is going to be a test of the March lows. If not, the bear will suffer as the stock fills the gap before heading lower.

every sunken ship? Charts. This chart has a

few problems and might provide courage to the market bear. The short seller needs a high profile failure to pick-up any downside momentum. Another hard leg down in Google would convince us that there is going to be a test of the March lows. If not, the bear will suffer as the stock fills the gap before heading lower.

Thursday, July 19, 2007

Dow 14000

Dow 14000 may mean something to those round number folks but to traders other than the "always long" crowd, who cares. More importantly, is there anything in the price activity of the stock indexes that might indicate a pending price bolt or a price roll-over? Models currently

reveal a drag pattern which usually starts building approx. ten days out. Look for the markets to expand on gains but be anchored to sharp reversals thru the week of July 28.

reveal a drag pattern which usually starts building approx. ten days out. Look for the markets to expand on gains but be anchored to sharp reversals thru the week of July 28.

Tuesday, July 17, 2007

Soybeans

Soybeans have always been a wonderful trap. The bulls usually have to rely on the same old weather related developments, hot and dry. Now you can have dry without the hot, but never hot without the dry. Even still, farmers always get those crops in and they always get them out. Whatever the American farmer cannot grow due to crop problems, the South American farmer can. Historically, this ultimately has led to carryover problems. Too many beans. This makes life for the bulls tough.

Looking at the soybean market over the last two sessions, it seems to be another broken dream for the bulls. Last Friday the beans were in launch sequence. The great liquidity giant in hedge fund form was long. However, the limited skills of the weathermen appeared to be illuminated by a slight change in forecast when the very hot was replaced by the very wet. Ouch. Of course commercial grain companies were thus glad to help the longs on the opening Monday by offering as much for sale as they could eat. Always helping.

The bull has until about August 10th to kill the crop. If it has not been accomplished by then the dream of beans in the teens will have to wait.

Looking at the soybean market over the last two sessions, it seems to be another broken dream for the bulls. Last Friday the beans were in launch sequence. The great liquidity giant in hedge fund form was long. However, the limited skills of the weathermen appeared to be illuminated by a slight change in forecast when the very hot was replaced by the very wet. Ouch. Of course commercial grain companies were thus glad to help the longs on the opening Monday by offering as much for sale as they could eat. Always helping.

The bull has until about August 10th to kill the crop. If it has not been accomplished by then the dream of beans in the teens will have to wait.

Subscribe to:

Posts (Atom)