Last trading day of a year that saw the many one way positions with lousy risk managers get trashed. Risky underwriting usually means putting up less to in the hope of getting more. Being positioned correctly entails adaptive management with enough margin to back illiquidity during volatility. So many of the higher profile hedge types became vulnerable to every trader's nightmare, large position no market. The damage has rippled across Wall Street as described in an article about the smart money community.

Tags SP500 1480.75 NQ100 2114.25 STI D

Monday, December 31, 2007

Saturday, December 29, 2007

Same Lesson

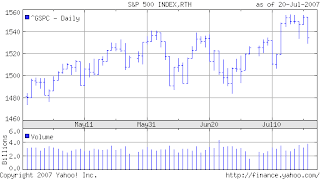

Designing trading models which are adaptive to a wide set of risk parameters is always a challenge. Beatings the hedge funds took this year always reveal liquidity issues which develop when models are implemented and ramped to achieve a high dollar returns. A net per unit return performance as represented in this chart allows for limited trade clock exposure and rampage. The debt models and their leg positions were helpless targets to trend reversals, squeezes, and poor management. Over trading big or small will eventually break your heart.

Designing trading models which are adaptive to a wide set of risk parameters is always a challenge. Beatings the hedge funds took this year always reveal liquidity issues which develop when models are implemented and ramped to achieve a high dollar returns. A net per unit return performance as represented in this chart allows for limited trade clock exposure and rampage. The debt models and their leg positions were helpless targets to trend reversals, squeezes, and poor management. Over trading big or small will eventually break your heart.

Markets Ending 07

Retreating index markets slid to a fall back position for the week. DJI currently up 7.23% for the year and is just six points from closing higher on the month. It has had lower monthly closes only four times this year with June and July being the only two consecutive. The SP5oo cash sits up 4.24% higher on the year and 6.2% off its October 11th high. The Nasdaq 100 spot futures made a weekly recovery high this week since the lows of November and now is 5.8% from o7 highs. The Nasdaq 100 cash is just under six percent from it's highs.

Retreating index markets slid to a fall back position for the week. DJI currently up 7.23% for the year and is just six points from closing higher on the month. It has had lower monthly closes only four times this year with June and July being the only two consecutive. The SP5oo cash sits up 4.24% higher on the year and 6.2% off its October 11th high. The Nasdaq 100 spot futures made a weekly recovery high this week since the lows of November and now is 5.8% from o7 highs. The Nasdaq 100 cash is just under six percent from it's highs.The bulls are still depending on the tech sector to save the rest of the market while the bears are building on a chart trail of three potential rally rollovers. There is enough downside to make o8 interesting but the bear has yet to drive the bull away.

Friday, December 28, 2007

Price Tags

Price Tags are not predicted ranges but rather price value areas from the previous day's trade which will usually be played during the next session.

Short Term Indicator (STI) Up, Down, Neutral.

Market Indicators

Yesterdays Score

Short Term Indicator (STI) Up, Down, Neutral.

Market Indicators

Yesterdays Score

Sunday, December 23, 2007

Journey to Lower

The collective energies of various economies have made the bear's journey to 'lower' a tough task. Whether it be global bank maneuverings or new announcements regarding cash infusions to aid stock positions, all have helped place a bid underneath the market. It is clear that parts of the outside world are awash in cash and the mortgage related sell-off in stocks has revealed an appetite to invest stake money, especially in the brokerage business. Whether this is all enough to stem the bear's prediction that the market has not priced in the coming downturn in the economy is yet to be seen. The bear has placed a few technical roadblocks in front of the bull certainly, (DJI 13780 and 13962, SP500 1526.5 and 1558.5) and failure to recapture at least the bottom of those ranges soon will add some downside momentum. The tech side of the markets has an easier path with much less resistance. A close over 2151.5 in the NQ100 will provide some upside courage for the broader indexes. The VIX however continues to wane as wide ranges have become the norm and bets that a range bound market will be the eventual outcome.

Monday, December 17, 2007

Lower But

Bears turned the market last week as the DJI and SP500 retreated on Fed and inflation news. For all the bear action however, the overall stock markets continue to absorb the selling helped by trend buying for 2008. The VIX has softened as ranges stay wide indicating that if the downside becomes the trend, it will be a grinder. There is no lack of bearish sentiment out there but technically the trend is sill the bulls to surrender.

Sunday, December 9, 2007

Week Compass

The week ahead shall probably determine the direction of the market for the remaining weeks of 2007. The DJI sits 540 points or 3.8% from it's all time highs. Whats more, it is only 337 points from closing above the October 31 high which would be a rejection of the October/November break. The bear camp has grown substantially in the last six weeks as the news of mortgage problems seemed to worsen. Other than the perennial bears, there is some genuine interest in the downside for the first time in years. Should the DJI make new highs this month, the bears will have to move their positions uncomfortably into 2008. This may prove to be a better bet as the current Fed activity will have played itself out, but shorts will be tired.

Monday, December 3, 2007

Next Time

The bears got this close to claiming technical victory last week but as usual could not accomplish much of anything. They are fighting various elements that include the Fed's renewed vigilance. Of course it is said that the Fed has little impact on the crucial matter of sub-prime loans, but try telling that to traders who are short. Like villagers carrying torches, big brokerage houses have stormed the Federal Reserve to seek relief in anyway possible in order to give their positions some type of edge. The irony of which is pointed out in Stein's article about Goldman.

Look for the bears to continue to seek turning points while trying to avoid the DJI close over 13982 and a SPX close over 1553.

Look for the bears to continue to seek turning points while trying to avoid the DJI close over 13982 and a SPX close over 1553.

Sunday, November 25, 2007

Which Way?

The Friday rally made the week easier to swallow for the bulls. The extremely light trade made a bottom tenuous, so the bear will be eager to sell any decent re-tracements. The great minds on wall street are looking for another rally to help salvage the mountain of bad trades created while trying to return alpha. The bears still have to close the market at lower levels and 08 bulls will be there to ease any fall. The interest rate markets are expecting lower rates again at the Fed's next meeting but stock markets will have to be making significant new lows for that to happen.

Sunday, November 18, 2007

No Knock-Out

There was no knock-out punch from the bears last week but they are still lingering at the market's edge. The year's end is in sight and the bulls are hanging on to additional Fed relief and the thought that next year will see gains so why not buy now. The bear is looking more long term and seeing the mortgage issues as a heavy drag on the consumer/investor. The outcome will be something in the middle and it might be best for traders not to expect too much from these markets from here. Vol animals will have to be satisfied with what they have experienced over the last two and half months and expect less. The trend is still on the bull-side for now.

Saturday, November 10, 2007

Bear at the Door

The bears are hoping to raise their flag if they can get another ugly down week. Tech, which all the other stock indexes had been tethered, got a dose of 'get out' from the professional side. As we stand, the NQ 100 cash is sitting 12.5% off of the August 16th reversal lows, with the SP500 cash plus 6% and the DJI sitting on a narrow plus 4%. Closes under the summer lows would provide the technical resistence area the bears could defend for some period of time. Relative to the other indexes, the tech play started back in June and as of late had left few opportunities. While Google and Apple are many times the face of the tech return stories, they become merely speculative trading stocks at the end of a run when values become stretched. They may catch late comers in those stocks with serious losses. The definition of a long term trader is one who is stuck with a loser. It may be the buy and hold crowd's turn to hang-on, but the bear's success will depend on tech.

Sunday, November 4, 2007

Bears Still Waiting

The ability of the DJI and other indexes to avoid the death dive has led to much confusion in the bear camps. Now we like to poke fun at the bulls, but the bears seem to be perpetually abused by these markets. Each time we have seen the market on the brink of destruction, (Aug. 16th, Oct 22, and Nov. 1st) the final whack fails to appear. Comparisons to various years where hard breaks or crashes appear are being made daily. The credit crisis and the toll on banks and brokerages are claimed to be clear evidence of impending doom. Since economic strength in world financial markets is continually credited to the shaky global growth story, one cannot help but feel vulnerable to the downside. After all, global growth is all about commodity prices, and if anything can turn to crap quickly it is any commodity chart. But the bear's problems stem from their inability to close below levels, such as last springs lows, which will bring out meaningful liquidation and not merely downside volatility. Now the NQ has significant buying interest by managers simply for being a relative value play compared to other indexes. But interest in that market here and abroad is the overall reason the market downside has been limited. Turn the techs down hard and the bears may just get their break, otherwise forget it.

Saturday, October 27, 2007

Big Week Coming?

Well the indexes just could not reverse the down action of the previous week and now must wait to see if the Fed can provide continued comfort. The two reasons for the overall support for the markets, it is explained on television, is liquidity and global growth. The first is represented by giddy types like Maria ' let them eat cake' Bartiromo laughing at the downside because, as she knows, markets never will go down as long as her checks keep clearing. The latter support explanation is of coarse the never ending supply of money created by global growth and the ever weakening dollar. Global growth really means China, and there so many Chinaman. Do the math. Let's face it, these markets will never ever go lower. Gold, oil, and every other commodity have entered zero gravity and wealth is a forgone conclusion. Well, until it goes down.

Sunday, October 21, 2007

Go Deep, Then Stop

Well, we did warn you. Lousy index action after the recovery of the August downturn has resulted in another index meltdown. This coming week's action will have great liquidation potential and may, if low enough, put in a low that the forth quarter that the bears will have to live with. Bond futures topping this week, oddly enough with most commodities, will have the markets looking for re-tests next week to the high ground from which they will fall. Some may of coarse, with the exception of the stock indexes which may find it hard to generate much upside interest in the next sixty days.

Sunday, October 14, 2007

Any Which Way

The heads are putting their spin on data for the final quarter. The argument over the real amount liquidity the Fed is providing is making guys like Gross of Pimco jaw about treacherous banking conditions. Ever since the rate cut the treasury futures have been heading south. Gross needs continued Fed easing for his current positions to work. John Hussman of Hussman Funds explains that the Fed has added virtually no reserves. Maybe that is why Gross is worried.

The miraculous recovery of the stock markets have allowed them to catch-up to the market performance of models known to consistently out perform the indexes. Hedge funds are piling in and buying from willing sellers who only a month ago thought they had missed their chance to get out at a decent price. These markets are running on upside energy and while that will of coarse end badly, it makes it more interesting for traders. We all want to be short when it fails, but the upside idiocy creates great opportunities daily to trade both sides.

The miraculous recovery of the stock markets have allowed them to catch-up to the market performance of models known to consistently out perform the indexes. Hedge funds are piling in and buying from willing sellers who only a month ago thought they had missed their chance to get out at a decent price. These markets are running on upside energy and while that will of coarse end badly, it makes it more interesting for traders. We all want to be short when it fails, but the upside idiocy creates great opportunities daily to trade both sides.

Tuesday, October 9, 2007

Bull Fish

DJI, SP500, and NQ100 knee-jerked a rally today after Fed minutes release. Pumping up the balloon continues despite the chances of another Fed cut seem unlikely. Various hedge managers are calling for substantial gains in stock prices over the balance of the year, but listening to them will not increase your IQ. These markets are tremendously overbought, but bubbles are always resistant to rational thought. Data the rest of the week is mild and will likely be viewed supportive regardless. Let the bull fish run with the bait.

Sunday, October 7, 2007

Indexes Smell

Back on September 10th we wrote about the bears inability to establish a downtrend. A Fed that is easily fooled and a buyside machine currently meeting little resistance while flying the global growth flag has the bear thinking ugh. But this market behaves oddly. Much like the ' new economy ' reasoning leading up to the tech bubble, the global growth rationale seems to have the same bad smell. Whenever the market is in bed with surging commodity prices, which are often used as evidence as to the validity of global growth, one has to wonder how long this party will last. The DJI, SP500, and NQ100 have had manic action ranging from the depths of a supposed global credit crisis on August 16th, to new highs in two of the three indexes last week. Whatever joy the bull believes waits ahead may be short lived given the current market construct.

Sunday, September 30, 2007

October Begins

Bunch of data this week but most think the fix is in anyway as far as Fed is concerned. Starting the last quarter with eye on new highs in DJI, SP500, and continued strength in the NQ100. October will be reversal month if there is to be one but the bears have little faith in their own abilities to turn the market. Commodity bubbles abound so their collapse would play badly for the world growth folks. The vix longs have been shelled so a rebound there is likely.

Tuesday, September 25, 2007

Betting On Direction

The impact of the housing on all markets is the topic of much discussion. The glacial movement of an illiquid market is hard to scope. It is fair to say that the all markets are in a large part tied to housing and the debt equity cash driver created over the last ten years. Since serious house value declines are being reported through out the US, the threat to the economy is probably being under played. Fresh from their victory of brow beating the little Fed chairman, wall street is pointing to the upside of Fed stimulation and the resulting rallying stock markets as proof. Commodity markets are still hot with large fund participation willing to bet that lower rates will provide free money. Tech stocks, the true leader of any real bull market, are poised to break out to the upside. So then which is it? Starting of the good times as in 1996, or gonna get real bad like 2000? The markets will tell us in October. Should the tech stocks fail in the current configuration and or commodities reverse, bet on down.

Thursday, September 20, 2007

Commodities

Commodities such as crude, wheat, and soybeans have entered the idiot rally phase where the lack of selling provides the bull with that bullet proof feeling. These prices are reflective of the overall environment perpetuated by the Fed for years. Money is free and tales of tight supplies have captured the attention of the limited trading abilities of hedge fund managers. This of course will all end badly for the longs, even the crude freaks who may have had the best of the price runs. Why? They will tack on a reason on the way down which will be of no analytical value to the bulls. Anything that comes out of the ground can be sold with certainty and this time is no different.

Wednesday, September 19, 2007

Down Outlawed

Markets continued their rise today after the Fed accommodations yesterday. Clearly one who dislikes confrontation, Bernanke capitulated to cries to save the trading houses and banks from themselves. The dollar continued its death dive as all the elements toward serious inflation have been put into place. The experts on wall street can assure you all is well only if there is free money and the markets are going up. Since a five percent correction now is considered a crash, immediate action is always required. The Fed has been convinced that always up is always better than anything down, regardless of any previous economic convictions.

Tuesday, September 18, 2007

Alan Bernanke

Just call him Alan. While Bernanke would like to fix the looming inflation problem, he lacks the fortitude to accomplish it. So what has changed since the Fed's previous stance on interest rates? Nothing. Starting with Greenspan, the Fed has worn out several pairs of knee pads giving wall street comfort. But hey, the Fed must be on top of things. They and their underlings are always conducting studies, economic studies. Deep stuff. Why Bernanke himself must have written tons of that crap. They might want to conduct a study examining the Fed's tolerance to withstand whining. A parallel study might be how the Fed might direct deposit money into bad trade accounts after heavy whining is detected.

Friday, September 14, 2007

Bernanke Charts

There is no doubt the Fed would be satisfied to see most futures charts head south for a time. The ten year, oil, wheat, gold, indexes, and others sliding in a dull but hefty correction as the Fed

provides an inflation fighting environment for the years ahead. This kind of squeeze on speculative investment initiated shortly after Bernanke took over is hard to orchestrate especially when wrestling with the financial instruments created over the last ten years. Projecting confidence while promoting corrections is even harder as free market wall street begs for a help. Save the little guy usually means save the big guy whether on wall street or across the vast agricultural lands covered by farm subsidies. Saving the bull trends is the current battle. Many of these charts look toppy or tired. Bernanke would like to give them a little push lower.

provides an inflation fighting environment for the years ahead. This kind of squeeze on speculative investment initiated shortly after Bernanke took over is hard to orchestrate especially when wrestling with the financial instruments created over the last ten years. Projecting confidence while promoting corrections is even harder as free market wall street begs for a help. Save the little guy usually means save the big guy whether on wall street or across the vast agricultural lands covered by farm subsidies. Saving the bull trends is the current battle. Many of these charts look toppy or tired. Bernanke would like to give them a little push lower.

Wednesday, September 12, 2007

Bolt or Bust

Somewhere in the technical nature of tops the marginal advantage turns to the sellers just a stories about absolute demand and waning supply are finally accepted. Whatever the market, this usually is followed by rapid declines and emptying P&Ls of the ever believing bulls. Commodities across the board have been in the bolt phase and may all be meeting at the top of the same balloon. Crude and wheat each carry the same question that claim all markets in rapid ascent, where to get? Global growth has been a huge factor in explaining all that rises. But there are no tsunami alarms to warn of the impending wave of selling should the global growth story suddenly be interpreted as over. These volatile markets make every good trader, short term or long ask, where to get out? For commodities the answer maybe here.

Risk Appropriate

As mentioned in other posts, managers are buying NQ100 for the long haul. Along with treasuries, the NQ100 is viewed as risk appropriate in an environment where performances have been hurt by various contrived strategies. Traders will look at Friday's commercial paper action to get a read on the taste for business debt. Despite positive action over the last several days, the market is vunerable to reversals. The August 8th highs are the benchmark for relative strength and could indicate technical roll over if not recaptured soon.

Monday, September 10, 2007

Bearly Lower So Far

Given the entire discussion over sub-prime/commercial paper implications, major brokerage house debt trading at junk status, and the supposed Fed's unwillingness to aggressively cut the fed funds rate, the bear would seem to be in the position to drive the DJI, SP500, and the NQ100 lower. New recession worries would certainly provide the bear market handle some credibility. So far however, the bear has been turned back. Failure to close under the March/April lows on August 16 did not help their cause. Of course it was quite interesting the market had such a powerful reversal the day before Fed intervention, but it pays to be wired to the inside. The reason for the indexes continued support, it is explained, is that the Fed will ultimately deliver whatever is needed in containing the downside and preserve the bull run. Now the Fed may not be as powerful as people would want to believe, but the bulls still hold the upper hand until some serious technical damage can be done.

Friday, September 7, 2007

Market Today

Today another range trade day with all indexes avoiding a test of the 50% retracement. It would seem hard to make a two hundred point break boring but the market succeeded. Big liquidation never seems to show up and there is enough interest in buying breaks that the downside is limited. Look for the markets to listen to Bernanke on Tuesday for further guidance on rates. Despite break today, technical damage still minimal.

Thursday, September 6, 2007

Open One Window Close Another

The Fed would like to open one window and close another. The first window being the discount rate strategy which soothes some of the liquidity issues for banks and more importantly promotes the image of a watchful central bank. On the other hand, closing the window on the Greenspan era is something Bernanke is trying to pull off but is finding it to be a tricky given that the markets may believe he has already created the ' Bernanke Put.' Regardless of the unemployment number on Friday the market will be concentrating on various strategies by the end of next week. A large treasuries bet has been placed and significant damage would be done initially to that market if the Fed were to avoid cutting rates. The bet primarily is that the Fed will cut and continue to cut. If they do not, it is reasoned, the market's resulting downside will force their hand anyway. The dilemma for the Fed is that there remains a sea of cash ready to move across stocks, commodities, and yes, even in real estate. It would like to temper demand by at least having the threat of higher rates as a weapon. Some are hoping Bernanke may reveal his intentions prior to their meeting allowing the for the adjustment to the up or down meter.

Wednesday, September 5, 2007

Taste for Treasuries

Treasuries had a nice move today as everyone in the hedge community loads up on the long side. The hedge monkeys will do one thing until in hurts and treasuries are their current flavor. Hunting for big returns has been replaced by the hope of that the client returns. Alpha now means being satisfied with traditional benchmark performance.

The markets are range bound until next when they either test the low or try to close over the August 8th highs. Either way there will be some swings with volume greater than the last ten sessions.

The markets are range bound until next when they either test the low or try to close over the August 8th highs. Either way there will be some swings with volume greater than the last ten sessions.

Market Pause

Yesterday's overall performance was encouraging to the net gainers but the internals acted poorly. This market is clearly in a range trade marked by the August 8th highs as resistance for the SP and the DJI. The NQ100 has eclipsed that high which is indicative of the continued play to buy the NQ for the long haul. Bulls have had the advantage since the Fed intervention but will have to now pause and see how the market deals with Friday's data.

Monday, September 3, 2007

Liquidity Mystery

Markets will fight the range this week with an increase in volatility picking up the week of Sept. 10th. Stories about the lack of liquidity during high volatility continue to be the topic when discussing various financial instruments. Treasuries are receiving the liquidity vacuum spotlight. Traders are shocked. Why? Liquidity disappears when price swings begin to become more erratic. Always has, always will. Convincing others to stand in front of a financial freight train and make a market for everyone else is tough. If it were profitable, everyone would do it. Half of the time traders do not know where the market is going. The other half of the time they really do not no where the market is going. The latter is when liquidity disappears as bids and offers are so wide you could drive a truck through them. Sometimes it is better to be on the truck.

Friday, August 31, 2007

Bear Challenge

Bears have been challenged today with news from the administration it will allow some guarantees on sub-prime loans. This effort along with liquidity measures by the Fed will allow the markets to continue to base. A test of the index's August 8th highs and a successful close above them will confirm the 07 bottom. The question of upside strength beyond current highs is the bull's challenge.

Thursday, August 30, 2007

It Hurts to Think

Today's action was mainly a NQ affair. Regardless of the market direction, their continues to be a play to buy the NQ over broader base averages and industrials. The relative strength view gives what appears to be an opportunity to buy an index some 50% off it's 2000 highs. Whether the players are right does not matter as much as what it says about the appetite of managers looking for investments they might be able to sleep with comfortably. Besides large bets by funds in treasuries for both actual hedging of bad debt trades as well as directional plays looking for Fed accommodation, their seems to be doubt as to the the rallying capabilities of the stock market. It may be that the overall long play in treasuries would suit the hedge community through the balance of the year since it would entail much less thought. That's if it works. Thinking has been a problem for them.

Monthly Data

The DJI monthly July close was 13212 and marked the second consecutive monthly lower close after the May record close of 13627. During the break, only the monthly lows after April were taken out in contrast to the SP500 spot futures contract which violated every monthly 07 low except the lower spike of March. Last month's close of 1462 was also the second decline after the record 1533 close in May. The bear needs to close under March 07 lows while the bull has less work but probably diminishing overall momentum.

Wednesday, August 29, 2007

Today North

The DJI for the last four days is up a net 53 points. The point being, relatively large ranges and diminishing real volatility (VIX) indicate that the high/low ranges have for the most part been established. Now in this instance the ranges would be the lows of August 16th and the July highs.

Market disappointment with the Fed could provide another test but Bernanke has basically opened the teller's window. Continued support work and lack of follow through on the downside will keep the bulls hopeful for a test of the highs in the quarter ahead. Push beyond that will be tough.

Market disappointment with the Fed could provide another test but Bernanke has basically opened the teller's window. Continued support work and lack of follow through on the downside will keep the bulls hopeful for a test of the highs in the quarter ahead. Push beyond that will be tough.

Tuesday, August 28, 2007

Slow Slide

Well two days and 330 points lower the market seems tired. Once again the DJI slid to close under 13162 and the other indexes SP500 and NQ lowered themselves into the support areas created starting back on August 10th. The bulls will hope tomorrow will finally bring in buyers who abide by the never buy the first rally rule. Whether or not the bulls can hold will depend on the continued wink wink nod nod from the Fed. The buyers are there, but they could just a easily decide to wait

Monday, August 27, 2007

Data Watch

The market staged a low volume pull back waiting for some kind of news to trade. Data will start to be released tomorrow which could have some impact with the volatility crowd hoping to recapture some panic. They will probably be disappointed but one can never discount the abilities of so many to flail about needlessly marking closes. Regardless, trade will focus on Sept SP500 1471 and Sept NQ 1950.

Sunday, August 26, 2007

So Far So

Indexes have built a first line base and have some measure of support on any corrections. The DJI, Sept SP500 and NQ100 look confirm a major bottom with closes over 13690, 1510.5, and 2006.75 which are the August 8th highs. If the market believes it has weathered the worst of the downside, there is plenty of cash to retest the season highs. Should that occur, liquidation will appear significant enough to make continued gains doubtful for some period of time.

Thursday, August 23, 2007

Quant Lessons

There have been generalized observations about the ' quant failures ' since the peak of downside volatility. The conversations basically revolve around the notion that all strategist were pointed the same direction. No doubt many brand name managers and their underlings got hammered, but in different strategies. The real problem was not that they all had indentical trades, it was their spread sides to cover risk were all related to everyone elses spread sides. The direct and indirect linkage pulled in directions contrary to there purpose, magnifying losses, shrinking liquidity. Building adaptive programs is absolutely possible, but brand funds will always be vulnerable to the mass they carry because by their very nature the are a target. In the end there is no strategy like the one that gets you out before the problems develop.

Today

Yesterday the indexes held above key support areas. DJI's 13162 remains the the critical swing. Volatility as measured by the VIX has taken a beating. However, if this market has doubts about the bull side trend, a test is most likely in the Thursday through Monday period.

Wednesday, August 22, 2007

Rally Roll-Over

Avoiding rally roll-over this week is needed to build both a base and the confidence that the worst of the break is over. Indexes are trying to chip an upside to see if there is hard rally room. The DJI and NQ still remain the strongest with the SP500 virtually flat on the year and the clear leader of the darkside. While some could argue that there was an overall overstatement of the sub-prime problem, it has brought caution to managers and those who look over their shoulders. The market break has also forced the Fed to be more reactive and will certainly soften the M&A deals. There is however still tremendous amounts of money in the system looking to apply leverage to a slightly changed environment.

DJI needs move above and hold closes above 13162.

DJI needs move above and hold closes above 13162.

Tuesday, August 21, 2007

Rebalancing

As the markets rebalance risk, the broad oscillations in the main line indexes will diminish. Skilled traders love constant volatility because the trade opportunity is ever present and scaled losses are recouped again and again. Great markets are tiring but worth it. However, volatility never visits long and the market adjusts back into the ordinary. Despite headlines of continued drama, markets figure out the important elements and flatten out the anxiety long before the talking heads do. Various markets sectors are currently in the transition phase with the flight to zero risk instruments relieving some of the volatility pressure. More important will be determining where the trend arrow is pointing and what strategies will work for the last quarter and beyond. For the indexes the arrow is still pointing up until they close under the March lows.

Monday, August 20, 2007

Edges

On July 24th the post looked at the how the advantage might be turning to favor the bears. Selling the rallies would become easier as the market struggled off of new highs. The edge maybe returning to the bull side during this week as we probe the ranges and try to base. The volatility crowd is convinced the large ranges are here to stay which is a fade requirement needed in any attempts to round out a base. Anything beyond this week will depend on the strength of the weekly close.

Building A Base

Market will try to build a base this week, trying to avoid an end of the week sell off. The SP500 has the most work to do and has to close back over 1500 basis Sept. futures to avoid remaining the weakest average. The DJI base building will be less an effort and if the average can hop and hold above 13162 the relative strength may pull the other averages up. The NQ also needs less help with a hold above 1930 basis Sept futures.

Friday, August 17, 2007

Fed Hopes

Markets closed well today obviously, with the usual accommodation from the Fed. The lessons learned about various risk profiles may have a ripple effect on future loaded positions, at least that's what the Fed is hoping. The market problems were created by the collective geniuses putting on the same trades backed by faulty spread/risk models. Adaptive models are exceptionally hard to come by as evident by the carnage heaped upon the hedge fund industry. The claims of risk neutral and virtual zero risk positions supporting the hedge fund structure are all crap. If you can still go broke in one day, it's the same old structure.

The markets will try to continue building a base next week, and if successful, may have some actual upside surprises. However, if next week they rally and roll over again, they we will be stuck in the lower to sideways zone.

The markets will try to continue building a base next week, and if successful, may have some actual upside surprises. However, if next week they rally and roll over again, they we will be stuck in the lower to sideways zone.

Jubilee

The easing by the Fed along will yesterday's price action, some how probably connected, has sent the bulls into the jubilee dance. The market angst, best represented in the media by whiners such Bill Gross and Jim Cramer, is not so much about the tangled relationships of the sub-prime mess, but about easy money. The cloudy features of various new financial products which have grown during a generation of a predictable and constantly accommodating Fed will continue to be a market feature.

Close of over 1436 sept sp and 1883 sept nq will build on yesterday's action.

Close of over 1436 sept sp and 1883 sept nq will build on yesterday's action.

Thursday, August 16, 2007

It's a Start

The DJI did some important work today and traded up from April price area mentioned in prior posts. Technicals indicated big time buying that was well beyond short covering. Tomorrow the markets will start to defend todays action and try to build a base through next week and ultimately try to reclaim some ground in the September to December period.

SP500 came up to this morning's post resistance but NQ lagged way behind.

SP500 came up to this morning's post resistance but NQ lagged way behind.

Triage

Warnings today that one or more of the large hedge funds have failed is keeping the lid on the market thus far. Gun shy Friday may also be a factor. The trader's prayer, ' thank God for the things I don't own ', is being recited often these days. As the Fed firetrucks start arriving the debate will be what is to be saved and what is to be marked ' do not resucitate '. The behind the scene boys are very busy right now.

Being Nimble

We have had orderly breaks since the highs for the most part. The ' wait till it gets ugly ' bears have been looking for the makings of a wash-out since we picked up downside momentum. There is no question that all markets including the commodities markets are smelling market confidence burning and the scrambling is noticeable. But all traders will tell you that while you have to me nimble around the downdrafts, at the same time one never knows where a bottom will appear. They are usually at levels lower than everyone thought, but the turn is rapid and steep. Followed by days of churning backfilling.

The bar is set a bit higher today for technicals. The SP500 futures and sept NQ100 futures need closes over 1433 and 1908 to build any solid action.

The bar is set a bit higher today for technicals. The SP500 futures and sept NQ100 futures need closes over 1433 and 1908 to build any solid action.

Wednesday, August 15, 2007

Exit Room

The Countrywide story was all over the place today. The stock was getting hammered as the rest of the market tried to rally. Then the rest of the market fell apart making new lows while Countrywide rallied 6% from its lows in the last hour and fifteen minutes of trade. As implied in the previous post, you think Merrill would ever give you a sell when a stock is 15 or 20 percent off the highs. They rarely do because they don't trade, they collect. The profits the brokerage houses announce from trading always look excellent in the quarterlies, but obviously marking asset values and determining profits can be a bit creative.

Market will have limp into next week looking for a bottom. Could lead to some record volatility again.

Market will have limp into next week looking for a bottom. Could lead to some record volatility again.

Nice Stop

Merrill gave a sell signal on Countrywide today which comes only after a decline of 46% off of the January highs. They had a sell stop a zero but decided to move it up. Not funny to those holding Countrywide but evidence of some great minds at work in the big brokerage firms. Together with the daily televised market pimps they provide a market analysis as useful as late night infomercials. They come at the markets from the transaction side not the trade side and occasionally have a trader on who might know something.

Some bargain plays are being made today on breaks but bigger commitments seem scarce.

Some bargain plays are being made today on breaks but bigger commitments seem scarce.

Market Value

Nothing seems to be going right for the bulls right now. The DJI closes at 14000 less than a month ago and turns south almost immediately. Then the sub-prime contagion spoils everything by forcing instituions to actually come to terms with the concept of market value. There are two kinds of market value. The first market value is made up by a wall street hedgefund guy amassing a large positions so the management fee is large enough so he can buy something really big. The second market value is the price the wall street guy receives getting out of all those losing trades before the market value of his positions are just a bit bigger than zero.

The new lows for the move in the indexes is led by SP500 with DJI and ND holding up much better. The bears would like a spike lower to break away from expanded ranges built from August 1st. The best friend the bull has is end of month trade activity which will look for values created by the break.

The new lows for the move in the indexes is led by SP500 with DJI and ND holding up much better. The bears would like a spike lower to break away from expanded ranges built from August 1st. The best friend the bull has is end of month trade activity which will look for values created by the break.

Tuesday, August 14, 2007

Churning Around

Churning lower today reflects the liquidation and trade adjustment process that continues to take place. Index futures have seen a significant amount of selling as managers lock in losses against open positions which seemed to have endless downside. Despite the threat of numerous institutional trading problems, the smart money has known for sometime who was most likely to develop problems given the sub-prime market conditions. We are nearing the squealing price for some of those trades where a market for those positions will be made.

Market Confidence

When Goldman announced it was putting up $2 billion dollars into the sagging Global Equities Opportunity Fund, and an additional $1 billion was being deposited by two influential investors, a story came to mind. It seemed similar to the events told by John Kenneth Galbraith in his book The Great Crash: 1929. He described how, in the face huge selling, several titans of business stood up and showed their confidence in the stock market buy purchasing large amounts of shares of particular stocks. The sell-off stopped for a day or so but soon resumed. Confidence is still the key ingredient in all these markets With the August 15 deadline for 45 day redemption notice on hedge fund withdrawals looming, it is clear that Goldman is sending a message that it wants large investors to trust them.

Looking at the half way back numbers from the April lows to the rally highs this year the numbers look like this; DJI 13162 , lowest close 13181. SP500 spot futures 1500, lowest close 1443. ND spot futures, 1928, lowest close 1929. Of the three indexes, the DJI still has the best relative strength while the broader SP500 is suffering. The range between March and July could be the price area we will see for awhile.

Looking at the half way back numbers from the April lows to the rally highs this year the numbers look like this; DJI 13162 , lowest close 13181. SP500 spot futures 1500, lowest close 1443. ND spot futures, 1928, lowest close 1929. Of the three indexes, the DJI still has the best relative strength while the broader SP500 is suffering. The range between March and July could be the price area we will see for awhile.

Monday, August 13, 2007

Adjusting

The markets continued to adjust to Fed participation and hedge fund balancing today. Several references have been made to the August 15 notice day for hedge groupies who want their money back in 45 days. Material changes in market perception about risk will limit the ability for certain positions to recover. Those bad positions have to be hedged and or liquidated through various manners that will ultimately keep a lid on potential upside moves. The global hedge geniuses have blamed market abnormalities for the reason their long side went down and their short side went up. Which is another way of saying the relational spreads went irrational, just like the managers who originally thought of the trades. Now hopes rest on the ability to adjust positions without big downside interference.

Sunday, August 12, 2007

Avoiding Scary

The major indexes will try to avoid the scary side of down this week. Bears will have to launch an assault knowing the Fed will continue to inject billions of dollars into the financial system if a break of any size appears. Bernanke is fighting against the Greenspan era of easy money which perpetuated idiot trades. The combination of liquidating and spreading out of them can take time.

The real question for the markets is determining if there any meaningful upside. Since October of 2002 these market have had an ability to digest bad news and continue the steady march upward. Overall, markets have yet to get wacked technically but could have plenty of churning downside. The DJI could stay in a range between the highs and April lows for an extended period.

The real question for the markets is determining if there any meaningful upside. Since October of 2002 these market have had an ability to digest bad news and continue the steady march upward. Overall, markets have yet to get wacked technically but could have plenty of churning downside. The DJI could stay in a range between the highs and April lows for an extended period.

Friday, August 10, 2007

The Close

Markets held in there today and closed well enough to avoid excessive hand wringing. The bear may have to give up some ground on Monday as the markets test first line upside resistance. Despite all the panic, the DJI and SPX closed higher on week. Bears will need to prove their case or be chased again.

Market Lines

Market holding in as of mid-session. Bulls need to close the Sept SP500 futures over 1475 and the Sept NQ's over 1963 to build another support leg.

Numbers

Summer 06 lows to summer 07 highs these markets have had quite a run. DJI has rallied just over 3300 points, the SP cash around 337 points, and the NQ spot futures rallied 620 points. The volatility catches the attention, but the damage is thus far limited. So if we look the 50% retracment of these rallies they look like this; DJI 12340 , SPX 1388, NQ 1767.

The markets today will wait for any words from Fed land while flipping around looking for

something to hang onto.

The markets today will wait for any words from Fed land while flipping around looking for

something to hang onto.

Thursday, August 9, 2007

Friday Looming

The markets traded down into the support made on August 6th and 7th. The treasury markets, while higher, interestingly seemed to take it all in stride.

Once again we are faced with a Friday death dive scenario, so it is important for the friendlies to hold the support lines. When real fear enters a market, there is suddenly no consensus on value, and getting out can make everyone goofy. The 'just keep the cheese just let me out the trap' rationale takes over. The sub-prime contagion is a bear's dream, but could wane if the Fed and friends work a fix. Implementing the Greenspan model of fixing the problem would entail the ' whatever money it takes' method. The Bernanke policy of course is to worry about inflation first. Of course if we break hard enough it will certainly make that policy work.

Once again we are faced with a Friday death dive scenario, so it is important for the friendlies to hold the support lines. When real fear enters a market, there is suddenly no consensus on value, and getting out can make everyone goofy. The 'just keep the cheese just let me out the trap' rationale takes over. The sub-prime contagion is a bear's dream, but could wane if the Fed and friends work a fix. Implementing the Greenspan model of fixing the problem would entail the ' whatever money it takes' method. The Bernanke policy of course is to worry about inflation first. Of course if we break hard enough it will certainly make that policy work.

DJI

The DJI has had the bulk of trading action around the area between 13600 and 13200 since the beginning of May. There have been 20 closes above 13600 and one close under 13200 made on August 3rd. In perspective, while retracement to 13200 represents half the gains of 2007, it is a mere 5.7% correction from the high. Closes over 13600 leaves the highs wide open. But while we have been volatile, it is not much of a correction. Typical corrections in any market are between 10 and 20 percent. Commodity traders of any experience have sat through many a 50% correction. Regardless of valuations and the other rationalizations, this market is fat in technical terms. It may continue to go up, but it is fat.

Another Test

Lower lows create another burden on the bulls given the all the work they have done over the last three sessions. Traders are nervous and any decent selling is magnified on the downside. Markets looking to avoid exhaustion break while building lows.

Wednesday, August 8, 2007

Climbing Ugly

Man that was easy. All you needed was a suicide wish to sell the rally today, and of course it worked. Then being equally clear minded you bought the break, and it worked. But of coarse the reality is that this market hunts down both the bull and bear while traveling through these ranges, keeping both camps uneasy. The bulls continue to climb out of the volatile lows made on August 3rd and 6th. End of the week trading has brought out some ugly closes. This will be an opportunity for the bulls to close it well if they can.

DJI, SP500, NDX

The DJI and NDX performing better than SPX. DJI and NDX trading above June highs but SPX trading back in April trading range. DJI and NDX need to drag SPX up or get dragged down by the broader index.

Accommodation

Talking heads miss Greenspan. They could always count on him to buckle under market pressure and give the market any accommodation. Bill Gross of Pimco cannot believe the Fed has not lowered rates despite his expertise on these matters. Jim Cramer's certitude about what the market needs comes from a career of being wired to the inside, surely Bernanke will listen to him. So far however, the Fed chairman is telling the market to 'trade it' knowing inflation is the big issue and interpret data released against that policy.

Tuesday, August 7, 2007

Spinning Out of the Turn

The market gave everyone a few spins today and when they rang the closing bell all one could say was that is was another great day for the transaction business. The bears had a great chance to put this market on the run when they got the DJI down over 100 and the SP500 and NQ100 making new session lows. But quickly the rally began and the short covering became a race. The chart crowd began chanting 'bottom, bottom" and all seemed lost to the bear. However, the market used up a great deal of energy today on this rally and the outcome is still in doubt.

Support

Key support held this morning on the break. Support areas move up to 1464 Sept SP500 and 1958 Sept NQ. Models are rotational.

If the market is disappointed after the Fed announcement because there is no wink in the bulls direction, bears have enough strength to do damage. A serious break will bring out the usual whiners who want to be saved from themselves. Money is still cheap, so it is not the just the mechanics of a rate cut, it is more the perception that the power of the Fed is ready to help repeatedly if necessary. The bulls need to build on the price reversal of yesterday quickly.

If the market is disappointed after the Fed announcement because there is no wink in the bulls direction, bears have enough strength to do damage. A serious break will bring out the usual whiners who want to be saved from themselves. Money is still cheap, so it is not the just the mechanics of a rate cut, it is more the perception that the power of the Fed is ready to help repeatedly if necessary. The bulls need to build on the price reversal of yesterday quickly.

Monday, August 6, 2007

Money's Worth

Show up and these market ranges provide opportunities that traders appreciate. No real selling showed up today and the short covering rally started in the second hour of the day session. The bulls again thwarted an attack while on the run and turned the market around a day before the Fed meeting. The trade will start again in earnest after the tomorrows Fed announcement.

Key technical areas will be 1462 in sept SP500 and 1453 in sept NQ100.

Models are rotational.

Key technical areas will be 1462 in sept SP500 and 1453 in sept NQ100.

Models are rotational.

Sunday, August 5, 2007

Circle the Wagons

This weeks scheduled Fed meeting comes at an interesting time for the markets. A continued shaking of the world trading cage may have to take place to get the Fed's attention. Handling the psychology of falling markets usually entails the Fed circling bank and big brokerage wagons around a central theme of liquidity for all. Defending the buy and hold crowd from the misfortunes of an environment created by large owners of debt will create some opportunities. Of course those opportunites will be for the meeting participants. Market tranquility, it is reasoned, will benefit everyone.

Comparisons to LTCM really do not matter much as the markets seek to regain a footing, though reviewing LTCM and the deals that were cut is interesting.

Last Sunday's post seems appropriate to start the trading week as it did last week.

Comparisons to LTCM really do not matter much as the markets seek to regain a footing, though reviewing LTCM and the deals that were cut is interesting.

Last Sunday's post seems appropriate to start the trading week as it did last week.

Friday, August 3, 2007

Bear?

The SP500 and NQ100 could not hold the critical technical areas today. As mentioned last Friday's post, this was a battle week where the bulls could step forth and put the debt and fret stories to rest with a solid performance while risk was being adjusted. Some powerful rallies were launched only to be met today with big liquidation and now, short selling. The bulls have staked out a space on a ledge where it is hard maneuver. There remains a small foothold to climb back on, but a fearful downside move on Monday would leave this market in the bear's shadow.

Models are south.

Models are south.

Thursday, August 2, 2007

Bottom or Top?

After the selling the market absorbed yesterday and the action today, the SP500, NQ100 and the DJI look prepared to build on two days of success. The bears may not be willing to give up just yet however. The test area will be the ability to stay above 1272 for the Sep SP500 futures, and 1968 in the Sep NQ futures. While closes can make a price look safe, the action lately puts any price in the potential trading range. The week has allowed the market to field some volatility and price action to levels where there was enough buying and diminishing liquidation to halt the break. The market has been tested, but visiting the lows again would be a problem.

No change in models.

No change in models.

Wednesday, August 1, 2007

Stir It Up

The market had a little of everything today. Overnight break followed by an overnight to morning rally. Volatile trade trying to make a bottom in order to prevent a raid on the remaining 2007 market gains. Traders love opportunities but even these markets provide no edges just ledges when you participate. There is no question the market is adjusting risk in various sectors and that process takes awhile. Analysis of the sub-prime problem has repeatedly emphized that it is the unknown debt problems that are creating the volatility. Actually, there is little that is not known to the large players but the ones in the right position are in no hurry to make a market for the suffering. Those holding the lousy positions will just have to trade out of them. The volatility is more a liquidity issue. No one will help you with that bad position, until they race you to an unpleasant price.

The market absorbed a bunch of selling today for the first positive technical action in weeks.

Models are rotational.

The market absorbed a bunch of selling today for the first positive technical action in weeks.

Models are rotational.

Tuesday, July 31, 2007

Buy and Bale

The bulls looking for a bottom would have much rather bought a sharply lower opening than the rally that appeared this morning. Buying and baling can get tiring. The sellers have had a tactical advantage over the past week and can sell most rallies without extreme pain. Chopping down into a bottom over the next few sessions would suit many friendlies. However, the price action on the downside is as bad as it has been for sometime. This is a liquidation break and those can have some ugly momentum. Models are rotational.

Monday, July 30, 2007

Hammerville Revisited

The markets revisited the area they were routed from late Friday. The DJA 13400 and the SP futures 1485 now will become a technical focal point over the next few trading sessions. The bulls have once again demonstrated elements that have made the bull run famous, the ability to take a pounding. The bulls however may be pressed to repudiate the entire break in order to avoid the hammer beyond this week. Whatever the reasons for last weeks break, the volume and volatility are clear signs that a further roll-over in price action may increase the downside velocity.

Models are still rotational.

Models are still rotational.

Sunday, July 29, 2007

Heavy Lifting

There are times when it pays to watch the trade a bit more than you trade the trade. The various tremors rumbling through the market are the sounds of larger players moving the furniture. That may become more of a factor in the week ahead. Readjustments, liquidation, and margin conditions can bring about situations where it is better to let some of the giants wrestle. Large positions executed by various players can set previously successful strategies spinning. Traditional technical indicators may become distorted and unreliable. The RSI crowd and other limited over sold over bought programs will be of no use. Many times initiating a trade will be like grabbing onto a fast moving object.

The bulls will have every opportunity this week to prove they are still in control. They can be aided in a variety of ways that include the Fed. Most of all it will be how fast they can leave a bottom behind them.

The bulls will have every opportunity this week to prove they are still in control. They can be aided in a variety of ways that include the Fed. Most of all it will be how fast they can leave a bottom behind them.

Friday, July 27, 2007

Just in Case

Late in the session the traders and managers implemented the 'just in case the market sucks Monday' strategy. The bears kept on hitting it without enduring hardly any pain. If you believe that it is not how they start, but how they finish, then start packing. Next week, a serious battle for a market bottom will take place with the bears looking to ride the liquidation train to a level that even they would buy. Of course they will be looking to sell any meaningful rallies. Models had a lot of rotation today even with the late sell off. Next week will bring what traders live for, volatility and opportunities to make money moving both ways.

Thursday, July 26, 2007

Raise Your Forks?

This market is tired of lugging the bad credit story and the gamed numbers that every earnings report seems to bring. Whether the "liquidity tsunami" as it has been called can save the bull run will be of great interest. The market will fight to make a bottom next week after the friendlies trot out the "nothing has changed" overview. They may be right but todays action is coming off a recent new high, not a lengthy pullback. This type of market rejection creates willing sellers on decent rallies. Models have moved from pointing south to rotational.

Wednesday, July 25, 2007

Technicals

The crunch areas for the SP500 and NQ100 futures are 1532.5 and 2035 respectively. The bulls have always been able the wait for the next train coming through and looking at the data there are few difference between the last seven days of action and other market setbacks. However, the models keep on leaning south and have yet to return to their 'that's enough break' config. The bear needs to see the DJA take out the lows of the plus 285 rip day (13600) and slide through the July lows before raising the fork.

Tuesday, July 24, 2007

Wackage or Wreckage?

Tuesdays as mentioned in the previous post have been a sore spot for the stock market. But will this break prove to be anything more than the previous nine or ten head fakes lower. If you listen to people like Bill Gross of Pimco, the end is always near. Never one to avoid his position, he has been brow beating the Fed over the need to cut rates as Pimco's long bond positions have had to endure hard breaks. Now bonds have rallied, stocks seem a bit shaky, and it all may be enough to turn on the stock disposal. The models are heavy but will run out of gas without big downside. But the tables may have turned a bit. Instead of the bull always being forgiven, it may be the bear's turn to have more opportunities to escape. Of course, waiting to escape from trades is always so pleasant.

Tuesdays

Tuesdays seem to be a bit hard on these markets. February 27th and March 13th fell on such a day of the week. Here the market is somewhat vulnerable to 'wackage' since it comes after a session which appeared to put a bid in the market. Traders can sense weak legs when taking out the previous days lows and will push the downside to see if there are stop loss points. If this market decides the credit problems will exceed any glee from earnings , then the bears will begin to recapture some listeners.

Monday, July 23, 2007

Price Construct

Our models crunch the SP500 and the Nasdaq100 indexes which are used as primary indicators for overall market technical conditions. Their performance measures the strength of the "price construct' that is occurring during the coarse of the trading day. The 'construction' and deconstruction of price is probed using buy and sell decisions executed by the models. So what are they saying? See Dow 14000 post.

Our models crunch the SP500 and the Nasdaq100 indexes which are used as primary indicators for overall market technical conditions. Their performance measures the strength of the "price construct' that is occurring during the coarse of the trading day. The 'construction' and deconstruction of price is probed using buy and sell decisions executed by the models. So what are they saying? See Dow 14000 post.

Sunday, July 22, 2007

What is the old line? What's at the bottom of

every sunken ship? Charts. This chart has a

few problems and might provide courage to the market bear. The short seller needs a high profile failure to pick-up any downside momentum. Another hard leg down in Google would convince us that there is going to be a test of the March lows. If not, the bear will suffer as the stock fills the gap before heading lower.

every sunken ship? Charts. This chart has a

few problems and might provide courage to the market bear. The short seller needs a high profile failure to pick-up any downside momentum. Another hard leg down in Google would convince us that there is going to be a test of the March lows. If not, the bear will suffer as the stock fills the gap before heading lower.

Thursday, July 19, 2007

Dow 14000

Dow 14000 may mean something to those round number folks but to traders other than the "always long" crowd, who cares. More importantly, is there anything in the price activity of the stock indexes that might indicate a pending price bolt or a price roll-over? Models currently

reveal a drag pattern which usually starts building approx. ten days out. Look for the markets to expand on gains but be anchored to sharp reversals thru the week of July 28.

reveal a drag pattern which usually starts building approx. ten days out. Look for the markets to expand on gains but be anchored to sharp reversals thru the week of July 28.

Tuesday, July 17, 2007

Soybeans

Soybeans have always been a wonderful trap. The bulls usually have to rely on the same old weather related developments, hot and dry. Now you can have dry without the hot, but never hot without the dry. Even still, farmers always get those crops in and they always get them out. Whatever the American farmer cannot grow due to crop problems, the South American farmer can. Historically, this ultimately has led to carryover problems. Too many beans. This makes life for the bulls tough.

Looking at the soybean market over the last two sessions, it seems to be another broken dream for the bulls. Last Friday the beans were in launch sequence. The great liquidity giant in hedge fund form was long. However, the limited skills of the weathermen appeared to be illuminated by a slight change in forecast when the very hot was replaced by the very wet. Ouch. Of course commercial grain companies were thus glad to help the longs on the opening Monday by offering as much for sale as they could eat. Always helping.

The bull has until about August 10th to kill the crop. If it has not been accomplished by then the dream of beans in the teens will have to wait.

Looking at the soybean market over the last two sessions, it seems to be another broken dream for the bulls. Last Friday the beans were in launch sequence. The great liquidity giant in hedge fund form was long. However, the limited skills of the weathermen appeared to be illuminated by a slight change in forecast when the very hot was replaced by the very wet. Ouch. Of course commercial grain companies were thus glad to help the longs on the opening Monday by offering as much for sale as they could eat. Always helping.

The bull has until about August 10th to kill the crop. If it has not been accomplished by then the dream of beans in the teens will have to wait.

Subscribe to:

Posts (Atom)